The Greenbrier Companies - An Investment Thesis

First, an overview

The Greenbrier Companies (GBX) is a leading freight car manufacturer that has been overlooked despite several improving fundamentals. GBX benefits from a durable moat, low competition and a strong competitive advantage to generate higher returns on capital. The company has notably expanded margins, increased return on invested capital (ROIC), and raised their recurring revenues with ample growth potential remaining. It’s led by a capable management team that is focused on efficiently allocating capital and returning it to shareholders. Despite the company's operational successes, the market still perceives it as overly cyclical, resulting in the stock trading at historical lows. The railcar industry is also improving, as it has reduced capacity and operators have diversified their fleets, in turn making them less prone to cyclical downturns. Given GBX’s improving fundamentals, market share leadership, durable moat, and favorable industry condition, the company presents a compelling investment opportunity.

Founded in 1919 as a steel fabricator in Oregon, The Greenbrier Companies has evolved into a leading manufacturer of railroad freight car equipment. The company now operates across North America, Europe, and South America. Greenbrier has taken ownership stakes in multiple entities that include U.S axle manufacturing, Brazilian railcar manufacturing, and Brazilian casting and components parts. The Greenbrier Companies’ customers are railroads, leasing companies, financial institutions, shippers, and transportation companies.

Greenbriers derives revenues from three sources:

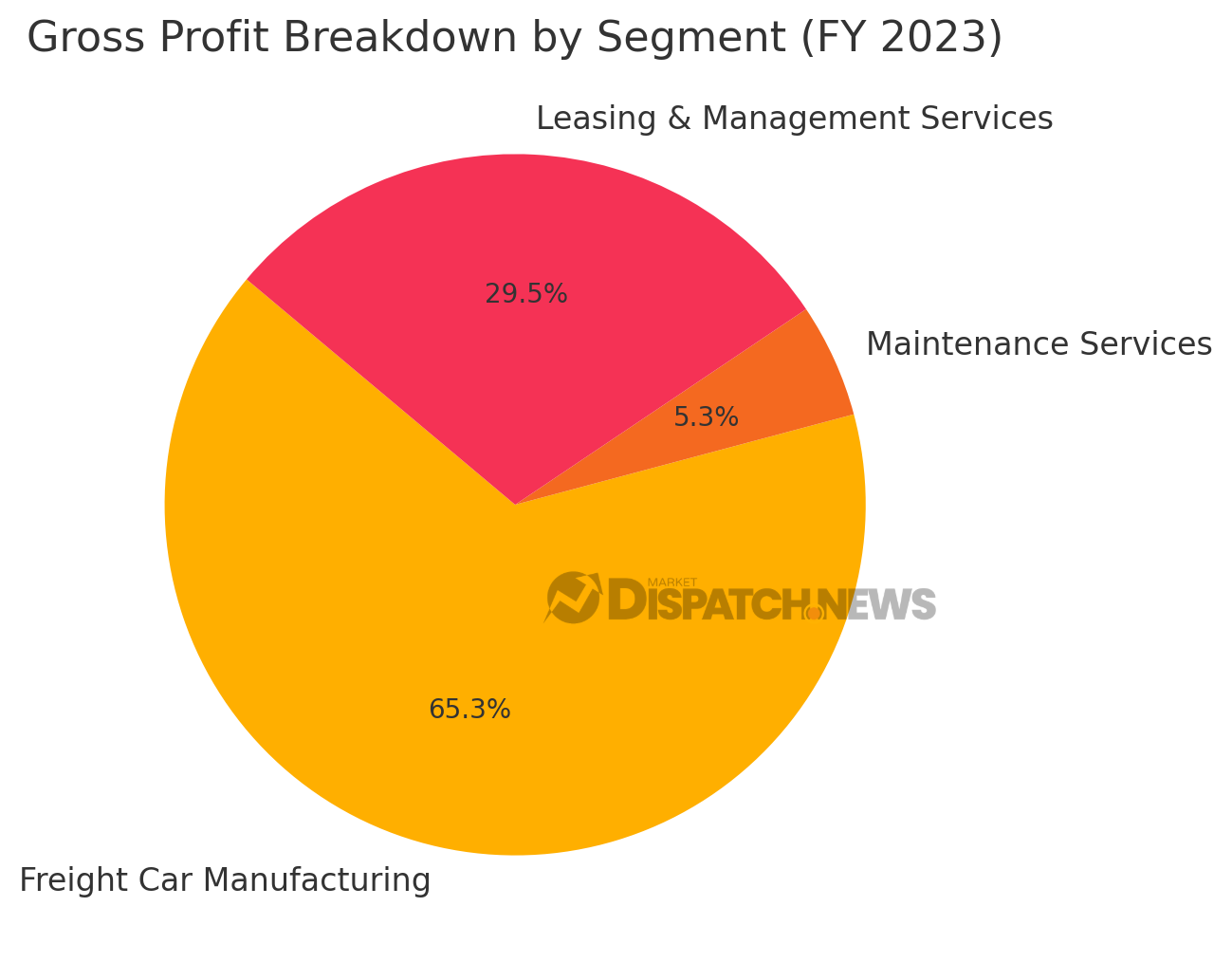

- Freight Car Manufacturing (85% of Revenue, 62% of Gross Profit FY 23) – GBX manufactures most rail car types in North America and South America including freight rail cars, tank cars, intermodal railcars, automotive, and sustainable conversion. In Europe, they produce a variety of freight car types and pressurized tankers. GBX has an estimated railcar manufacturing backlog of $3.7 billion which provides guidance for future revenue value and industry demand.

- Maintenance Services (10% of Revenue, 5% of Gross Profit FY 23) – GBX operates a wheel service network that provides reconditioning for wheels and axels, as well as new axle machining, finishing, and downsizing. The railcar maintenance network performs routine upkeep for third parties and their leased and managed railcar fleets. They also have component parts facilities to recondition and manufacture various railcar items.

- Leasing and Management Services (5% of Revenue, 28% of Gross Profit FY 23) – GBX operates a railcar leasing business in North America through subsidiaries with a fleet of 15,200 railcars. As of Q3 ‘24, The fleet utilization rate was 99% with an average remaining lease term of 3.9 years. GBX originates leases for railcars which are held in the fleet, or sold with leases attached to financial institutions or other investors. With the ability to originate leases and being an equipment owner, GBX primarily utilizes operating leases. Railcar leasing is a key growth driver as it improves and stabilizes earnings. The management services business offers a broad array of software and services that include railcar maintenance management, railcar accounting services, total fleet management, fleet logistics, administration, and railcar re-marketing.

Before diving into the railcar manufacturing and leasing industry, it’s important to get an understanding of the freight rail industry in North America. Freight rail is considered the largest, safest, and most cost-efficient freight system in the world. It’s an integrated railroad network covering roughly 140,000 miles across North America. In a typical year, freight rail ships around 59 tons of goods per American every year. The most common goods transported by rail include grain and other agricultural products, fertilizers and their raw materials, plastics, coal, construction materials, crude oil, and automobiles. The shipping of all these goods can require different railcar types such as boxcars, hoppers, flatcars, coil cars, gondolas, tank cars, and center beams. The most common mode of transportation on rail is intermodal, which is essentially the transport of a large container between sea and land. The Intermodal mode is responsible for just about everything you’d find on a retailer’s shelves. Last year, intermodal transport made up 49% of the 34 million units of freight carried by U.S railroads, more than four times higher than coal (the next largest commodity). As os 2024, there were approximately 1.64 million railcars in service within the North American rail system. Of these, 16% were owned by railroads, 56% by lessors, 18% by shippers, and 10% by TTX (a jointly owned subsidiary of railroads). As the American economy grows, the need to transport more freight will grow as well. The Federal Highway Administration forecasts that total U.S freight shipments will rise from an estimated 18.6 billion tons in 2018 to 24.1 billion in 2040, a 30% increase.

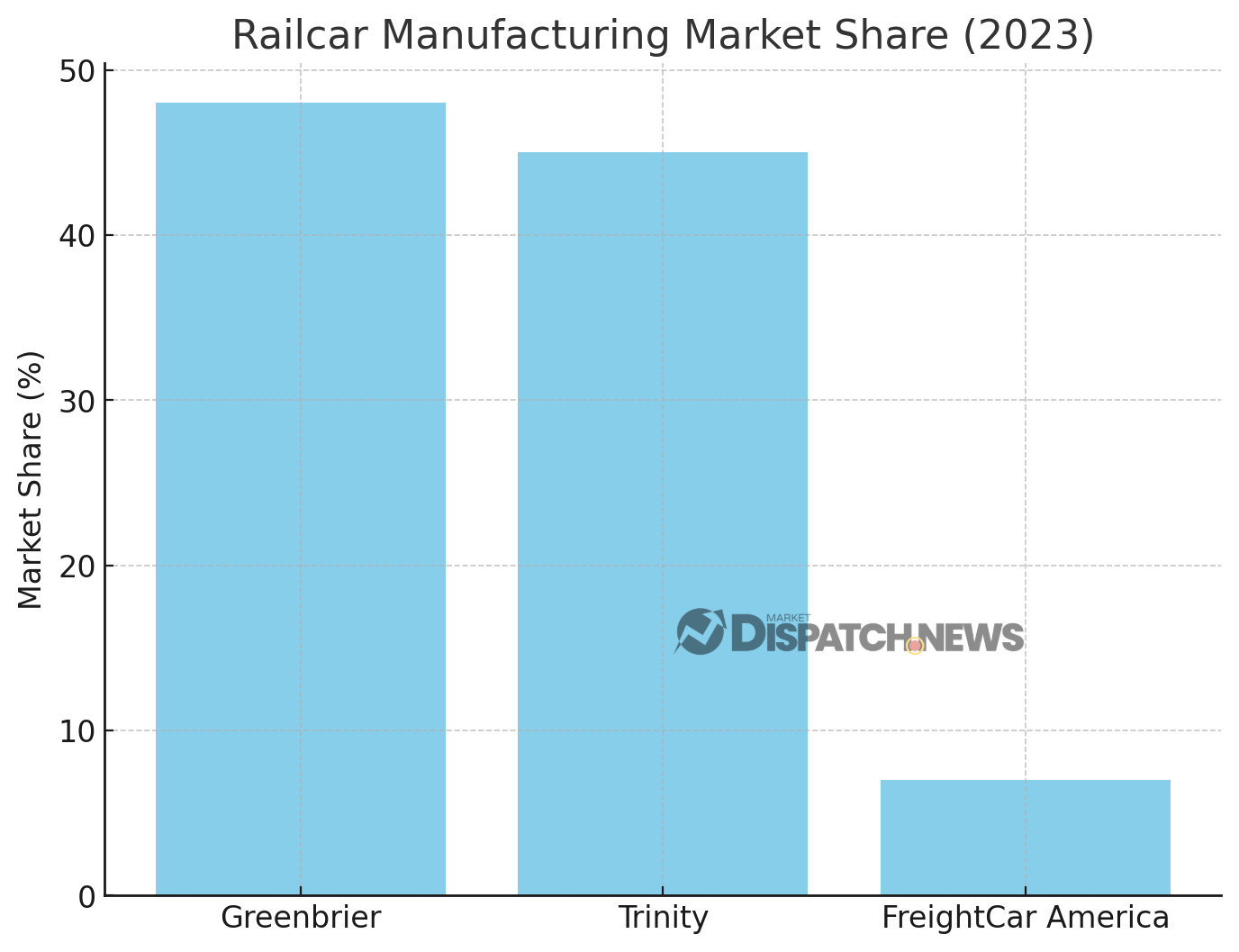

The U.S railcar manufacturing industry is composed of 3 publicly traded companies, which combined for a total of $7.2 billion in the LTM. Greenbrier has 48% of market share while Trinity industries and Freight Car America have 45% and 7%, respectively. Greenbriers dominant market share can be attributed to having a leadership position across all major product types of railcars, with diverse manufacturing capabilities that are vital for customers requirement changes.

Over time, the North American manufacturing of railcars has consolidated and reduced capacity. From 2020 to 2023, the railcar fleet saw a net reduction of ~37,0000 with a retraction in production. To put the reduction of fleet size in perspective, from 2017 to 2019 there was an addition of ~25,000 railcars. In 2000, there were 19 active production sites, while in 2022 only 11 were still active. The Greenbrier companies operate 5 of the 11 production sites. The reduction in production has helped mitigate the industry's cyclicality, which is primarily a supply-side issue. When the economy is doing well the industry produces too many railcars, far surpassing the replacement demand between 35,000 to 45,000 railcars. Replacement demand refers to the need for new railcars to replace old or worn-out ones. Current production capacity ranges between 60,000-70,000. As manufacturing capacity and production have decreased, the railcar industry is experiencing an upswing, having worked through the excess supply from the previous boom.

Another segment in the railcar sector is the lease of railcars. The leasing of railcars has seen a secular shift vs owning, and the Association of American Railroads has estimated its growth at a CAGR of 6.7% from 2021 to 2026. There are many factors that would lead one to lease vs buy a railcar, such as operational costs, risks, and market activity. The purpose of leasing is to have access to the equipment to ship goods without the costs associated with ownership. Lease types can vary, but one commonality among leases is that all dictate conditions regarding when, where, and how the leased railcars may be used. The decision to lease railcar equipment comes down to the cost effectiveness. Companies with high shipment volumes are likely to lease or own, as opposed to relying on railroads to supply railcars. There are two main types of leases for railcars; a full-service lease and a net lease. A full-service lease includes operating costs and responsibilities, like maintenance. A net lease has those costs and responsibilities given to the lessee. The amount charged per car per month to the lessee is affected by equipment demand, freight demand, lease terms, and railcar specifications. The railcar lessor market remains fragmented with 6 notable competitors representing 87%, and others holding 23% of market share. The 6 notable competitors are GATX, Trinity, Wells Fargo Rail, Union Tank Car, CIT, and AITX. They all retain similar amounts of market share in the range of 10%-15%, and other representing 23%.

So why invest?

#1) Durable Moat with Low Competition

The Greenbrier companies retain a durable moat due to the high difficulty of replicating their tangible assets, and their differentiated integrated business model. The building and maintenance of large manufacturing plants and repair facilities requires significant capital investment. These facilities are equipped with advanced machinery, robotics, and technology for the production and maintenance of railcars. Railcar manufacturing also involves specialized equipment for tasks like welding, painting, and assembly. These machines are costly to acquire and maintain. The onerous challenge of a direct competitor with GBX based on manufacturing capabilities is unlikely due to the tremendous capital intensity.

With the high capital intensity of GBX’s business, they also utilize a unique business model that provides them with a strong competitive advantage. GBX's unique capacity to service customers stems from its integrated business model. This model combines the ability to sell railcars with leases attached, manufacturing capabilities, maintenance shops, railcar specialization, and expertise in lease structures. This comprehensive approach sets GBX apart from its competitors. Trinity Industries is the only competitor that comes close in terms of railcar offering options. However, they lack the extensive maintenance network that GBX provides.

Analyzing from a Porters 5 forces perspective, GBX operates with low threats of new entrants and a low competitive rivalry. The entrenchment of the GBX business model within the railcar manufacturing industry renders new competition dubious and existing competition to waver. The high difficulty of replicating GBX’s assets paired with low threats of new entrants and a low competitive rivalry creates a wide moat business, fit for a long-term investment.

#2) Improving Fundamentals Disregarded by Investors

The Greenbrier companies have several strengthening, fundamental factors that are representative of a great investment opportunity. GBX has elicited the ability to reduce costs to increase margins, increase recurring revenues to stabilize earnings, and generate higher returns on capital deployed all while investors have paid little mind. In 2022, gross and operating margins hit a low of 10% and 2%, yet since, GBX has steadily increased margins that are returning towards pre-pandemic ranges of ~17% and ~11%. GBX is undergoing many rationalizations, cost optimization, and fundamental manufacturing efficiencies to provide margin enhancement, including the expansion of in house manufacturing as well as general manufacturing optimizations. The expansion of in-house manufacturing is expected to create savings of around $50 to $55 million, and manufacturing optimizations are expected to drive around $15 to $20 million in savings by 2025. Since the announcements of these initiative’s, gross and operating margins have hit 15% and 8%. As margins have been improving, GBX has also begun investing significantly into their leasing fleet to increase recurring revenues. Investing heavily in building their leasing fleet remains an attractive opportunity because it will reduce the cyclicality of earnings and generate higher margin revenues.

Leasing provides consistent cash flow relative to outright railcar sales that are much more variable to economic conditions. GBX’s approach to leasing is to strategically stagger lease durations, meaning that they will not expire at the same time. This helps avoid any scenario where a large portion of leases come off at the same time, resulting in a large decrease in revenues. With the leases strategically staggered and the fleet set to grow, GBX will have much more predictable earnings. The leasing and management segment of GBX generated recurring revenue of $124.5 million and margins of 69% in FY 2023. GBX’s current lease fleet includes 15,200 units with a current utilization of 99%. They have grown leasing and management services from $117 million in FY 2020 to $179.9 million in FY 2023, representing a 53% increase. With the current success of the lease fleet, GBX has committed a gross investment of approximately $350 million a year into the leasing and management segment. I believe now is a great time to become a shareholder as they will begin to reap the rewards of higher returns on capital from their capex.

As GBX invests significant capital into their leasing division, it’s important to look at whether the return on investment is sufficient. In FY 2021, GBX had a return on invested capital of .66% which has since grown to 3.65% in FY 2023. The incremental return on invested capital for FY 2023 was 34.36%, exhibiting that the additional invested capital is value enhancing. GBX produces a reasonable turnover of 1x-2x on all the capital invested demonstrating it potentially enjoys pricing advantages versus the sector. As GBX continues to invest heavily into their lease fleet, I expect it to generate attractive returns on invested capital in the future.

Even with margins increasing, growth of recurring revenues, and higher returns on invested capital, the market remains uninterested. GBX’s stock price return from August 28 2023, to August 27 2024 is only 13.53% despite several fundamentals showing strength.

#3) Cheap with Capable Management

GBX’s management team has executed on all fronts in terms of their strategic initiatives. During their Investor Day in April 2023, management mentioned they planned to:

- Maintain market share

- Improve margins and efficiency

- Increase recurring revenues

They are currently ahead of their goals on improving margins, which are sitting at 15%, and recurring revenues are set to continue increasing, allowing them to reach their goal of ~$260 million by FY 26. The management team have also been proper allocators of capital by investing in high ROIC projects such as leasing, which will be a key driver of earnings in the near future.

GBX has opportunistically repurchased shares when prices are cyclically depressed, with a remaining amount authorized for repurchase of $46.4 million. GBX also has a quarterly dividend of $.30 per share representing an annual yield of 2.5%. Over the last 10 years, GBX has returned nearly $520 million of capital to shareholders through dividends and repurchases. When listening to the earnings calls it’s apparent that management is soft in their guidance, as they tend to refrain from getting investors riled up over high expectations. They guide solid standards which are often exceeded. With the management team being proper stewards of capital and executing on their strategic goals with a long runway for increased earnings, the stock remains at historically low multiples. GBX trades at estimated FY 2025 P/E and EV/EBITDA ratio of 10.5 and 10.4.

Financials

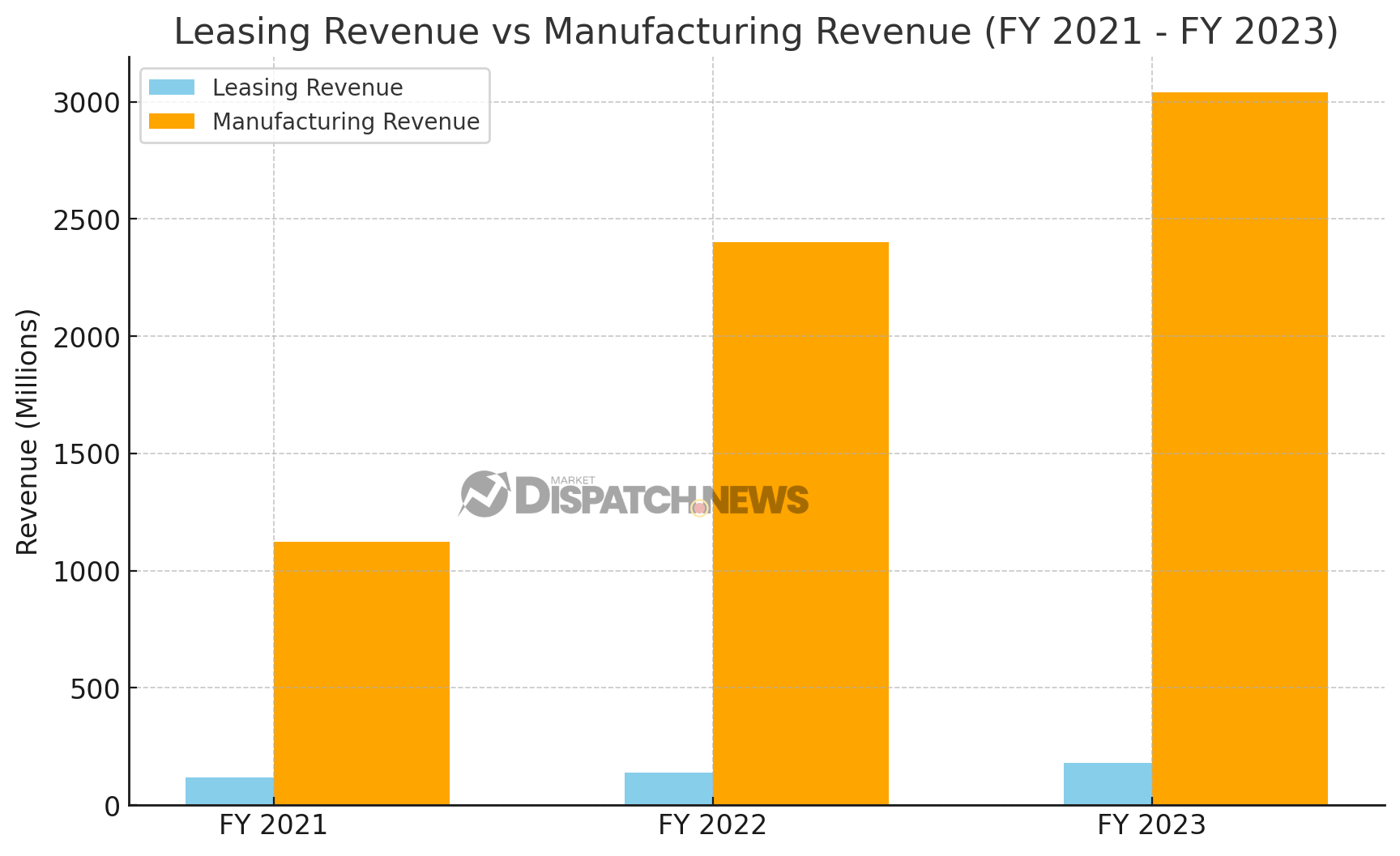

GBX has profitably grown revenue from $1.32 billion in FY 2021 to $3.57 billion in FY 2023, representing an increase of 152%. During the same period, the operating margin expanded from 2.2% to 5.2%. Earnings per share is estimated to increase 338% from FY 2021 to FY 2024. GBX has greatly increased their flow through margin dollars which can be explained by the factors above. The increasing margins can be partially attributed to the growing business segment, Leasing and Management. In FY 2023, Leasing and Management boasted a 69% gross margin, significantly outperforming manufacturing (8%) and maintenance services (10%). Despite accounting for only 5% of revenues, the leasing segment contributed 28% of gross profit in FY 2023. I expect the leasing segment to continue growing and contribute heavily into the growth and stabilization of earnings in the future.

GBX maintains high debt levels, with the debt-to-EBITDA ratio at 5.0x for FY 2024. This reflects the company's strategic decisions to leverage debt for expansion and operational needs. In comparison, the industry average debt-to-EBITDA ratio stands at 5.9x, indicating that GBX’s debt levels are relatively in line with industry norms, though slightly lower. The interest expense for FY 2023 was $75 million which would make for a 4.2x EBITDA/interest expense ratio indicating that GBX does generate sufficient earnings to cover obligations.

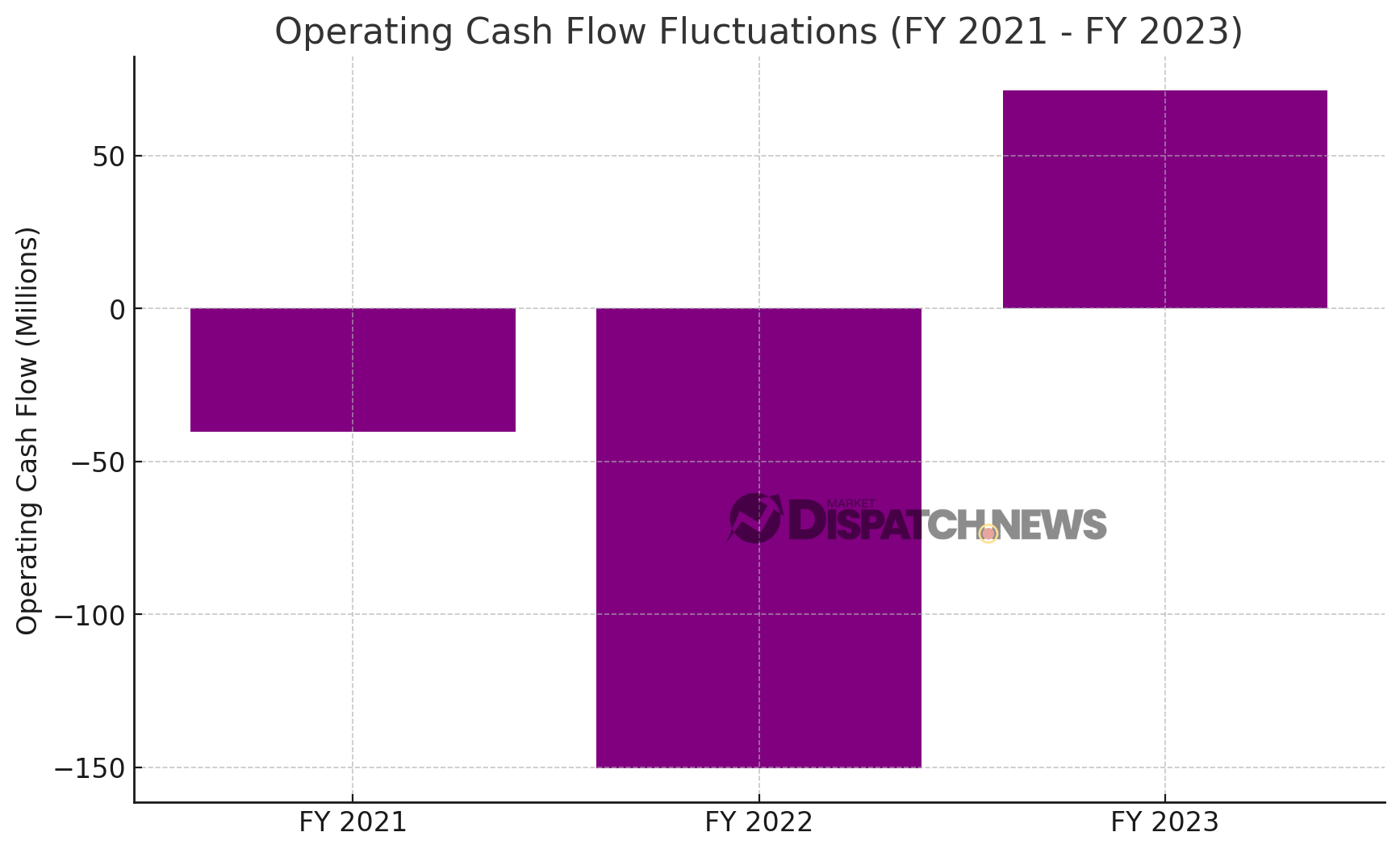

Looking at the cash flows generated from operating activities it’s clear that there are significant swings from year to year.

The past three fiscal years ’23, ’22, and ’21, GBX reported cash flows from operating activities of $71.2, -$150.4, -$40.4 million. The large swings can be attributed to fluctuations in net income but also notable changes in working capital. In Q3 and Q2 of 2024 GBX generated net operating profits after taxes of $55.9 and $34.9 million. After adjusting for net capex and changes in net working capital GBX generated a free cash flow of -$12.3 and -$3.9 million. The negative free cash flow can be attributed to the large amount of capex which is expected to continue until 2026. I expect the capital investment to pay off and GBX to generate positive free cash flow in 2027.

To gain a clearer picture of GBX’s financial position and strength it’s important to compare them to Trinity Industries and Freight car America in FY 2023 (Best Comparable). Analyzing profitability metrics such as return on assets and return on capital, GBX generated 3.3% ROA and 4.1% ROIC. The return on assets is above Trinity Industries of 2.3% however it’s below Freight car Americas 3.7%. Freight car America also has a ROIC of 7.9% vs GBX and Trinity’s 4.1% and 2.9%. GBX’s gross, EBIT, and Net Income all remain lower than Trinity Industries due to GBX having a lower percentage of lease revenues to boost margins. Freight Car America margins are all lower than GBX’s. Over the last 3 years GBX, Trinity, and Freight car have exhibited high revenue growth rates of 50%, 40% and 48%. This can be attributed to the resurgence of railcars post COVID. However, GBX’s and Trinity’s EBIT CAGR of 127% and 36.5% elicits GBX’s focus on operational efficiency. Looking at the KPI’s in the industry, GBX’s has a railcar back log of $3.8 billion vs Trinity’s $3.2 billion. The average selling price of railcars for GBX, Trinity, and Freight car were $124,183, $168,500, and $123,408. GBX also delivered 26,000 railcars vs Trinity’s 17,355 and Freight car Americas of 3,022. GBX has demonstrated strong growth and operational efficiency versus its peers making it a standout investment candidate.

Valuation

As of September 10, 2024, GBX share price trades at $45.59, valuing the equity at $1.42 billion. With net debt of $2.12 billion, the enterprise value stands at $3.74 billion. At the current price, I believe that GBX’s shares have room to appreciate considerably over a 1-3-year horizon based on expectations of +5-9% growth in annual per share profits and my view GBX currently trades at a valuation discount to its railcar peers in the U.S.

My base case is that GBX grow its EPS at an average rate of around 6% annually over the next 3-5 years, supported by increasing margins and revenue growth. In any case, GBX represents an asymmetric opportunity with an attractive risk to reward due to historically low valuation and increasing recurring revenues. Besides being a strong market leader, strengthening fundamentals, and stewards of capital trading at FY 25 P/E of 10.5x based on my estimates, another key point is the valuation gap between GBX and its railcar peers.

In comparison to its publicly traded peers, GBX is trading at discount on both a P/E and EV/EBITDA basis, despite having leading market share and higher earnings growth prospects. The most directly comparable company in terms of product/service offerings is Trinity industries which trades 23x ntm P/E. Trinity is the most similar due to manufacturing of similar railcars, providing maintenance services, and leasing railcars. I expect GBX with the continuation of growing their leasing segment and driving a more stable earnings stream, that it will warrant a much higher multiple. If GBX can eventually earn a below median multiple of 15x P/E multiple, based on my forecasts this would imply a 1-3 year forward share price range of $71.28 - $89.47 or a share price increase of 36% - 43%

Risks

The biggest risk for GBX is execution risk. GBX has laid out a plan to become a fundamentally stronger company however any slowdowns or mishaps in the trajectory of their goals could result in a decline in share price. If the company can’t grow and generate attractive returns on capital from its lease fleet this would put a lot of pressure on GBX share price as well.

To conclude

As GBX continues to improve its fundamentals the risk to reward will be hard to ignore. Operating in an industry with tailwinds from decreased capacity and high barriers to entry make GBX’s outlook extremely favorable to generate attractive returns. Trading at a historically depressed multiple with a capable management team focused on stabilizing and growing earnings, GBX remains a great opportunity for long term investors. I believe that GBX will generate higher through cycle higher earnings as they decrease cyclicality and improve operational efficiencies.

Comments ()