Is a Roth IRA Right for You? | Benefits for High-Income Earners and Beyond

Roth Individual Retirement Accounts (IRA) are one of the best long-term term investment accounts you can own and are superpowers for wealth accumulation. In this article, we break down what Roth IRAs are all about, their benefits, and some considerations and strategies for investors.

Let's get into it.

A Roth IRA is an individual retirement account to which you can contribute after-tax dollars. In other words, the money comes from your take-home pay. In most cases, you can open a Roth account with the bank where you already have checking and savings accounts. The key benefits of Roth IRAs are tax-free growth and income in retirement. These features can significantly reduce taxes and maximize retirement savings. Roth IRAs also provide major benefits for your heirs, which we will cover later in this article.

Roth IRAs exist to increase taxes received each year by the U.S. Government and get their name from Senator William Roth, the main sponsor of the Taxpayer Relief Act of 1997, which created the accounts. The bill aimed to provide retirement savings opportunities for Americans without inhibiting short-term tax revenue. As other savings options such as 401(k) and Traditional IRA accounts allowed investors to contribute income pre-tax, the government lost out on immediate tax revenues.

You can withdraw all the money in your account (after age 59 1/2 and if the account has been open for 5 years) without paying any extra taxes or penalties - a pretty sweet deal.

Many people also know about Traditional IRAs and wonder which account is right for them. So what’s the difference? When using a Traditional IRA, you contribute money pre-tax. This provides a tax reduction in the year you contribute money and funds grow tax-deferred, meaning you don’t have to pay taxes on investment growth until money is withdrawn. When you do take money from the account, withdrawals are taxed at your ordinary income tax rate. When you reach age 72, you must also take Required Minimum Distributions (RMD’s) each year from your Traditional IRA. The amount you are required to withdraw is based on the value of your account and how long you are expected to live. And yes, you’ll pay income taxes on these RMDs, too. Roth accounts, on the other hand, do not require RMDs and investors never have to pay taxes on withdrawals. The lack of RMDs can make Roth accounts extremely valuable for maximizing your retirement savings.

Key Benefits of Roth IRAs

The benefits of Roth IRAs include tax-free growth and withdrawals in retirement, a more flexible nature compared to other retirement accounts, no RMDs, and the ability to both reduce taxes and increase the inheritance of heirs.

Tax-free growth and withdrawals in retirement

The chief benefit of Roth accounts is that all investment growth, earnings, and retirement distributions are tax-free. This is especially powerful in cases where one’s income tax is lower in contributing years than in retirement. The bigger the gap between what you pay in taxes now versus later in retirement, the more a Roth account can help you out. Usually, younger investors get the most bang for their buck with a Roth IRA since their paychecks are likely to get bigger as they climb the career ladder. As younger, lower-income workers pay less in taxes than they might later in their lives, they often prioritize saving with a Roth over other retirement savings options.

"Invisible" nature to the IRS in retirement (no impact on taxable income)

Because you’ve already paid taxes on contributions with a Roth IRA, it’s like your distributions are invisible to the IRS which can really help keep your taxes down when you’re retired.

For example, Roth IRAs can provide tax-free funds in years when other income woud push a retiree into a higher tax bracket. You can withdraw from your Traditional IRA or 401(k) until you reach the top of a certain tax bracket and then mix in distributions from a Roth IRA to meet your needs without increasing income taxes.

Further, distributions from a Roth IRA do not count towards the Modified Adjusted Gross Income (MAGI) threshold that determines the Net Investment Income Tax (NIIT), an extra tax on investment income^1. The Net Investment Income Tax (NIIT) applies at a rate of 3.8% to certain net investment income of individuals, estates and trusts that have income above the statutory threshold amounts. For more information, see: IRS Q&A on Net Investment Income Tax

Withdrawals from other retirement accounts do count towards MAGI. Thus, RMDs could expose a retiree to the extra tax and Roth accounts can help avoid it.

Contributing to a Roth IRA is also a way to avoid income tax increases in the future. The top federal income tax rate remains below historical highs and there is no way to know if it might change.

To sum it all up, Roth IRA accounts can reduce tax liabilities for retirees and guard against future tax rate increases.

Flexibility for early withdrawals of contributions

Roth accounts are also valuable because they are flexible. For example, contributions to a Roth can be withdrawn at any time, for any reason, without taxes or penalties. Only earnings and converted balances are subject to restrictions. When a withdrawal is taken, it is automatically taken from what you put in first, meaning you’ll start dipping into converted money and earnings only when you’ve used up all your contributions. This allows you to take out the money you’ve contributed to the account if you need it to fund your lifestyle. This is pretty powerful as it allows you to use your Roth like a savings account while protecting your investment earnings from taxes.

No Required Minimum Distributions (RMDs) for account owners

We covered earlier how unlike Traditional IRAs and 401(k) accounts, there are no Required Minimum Distributions (RMDs) for Roth IRA accounts, but why is this so important? Because you are free from the RMD requirement, you can withdraw only what you need in retirement. You can even keep the whole account invested if you don’t need to take withdrawals, which significantly enhances your ability to grow your wealth. Money can grow tax-free for longer with Roth accounts because you are not forced to withdraw funds once you turn 72.

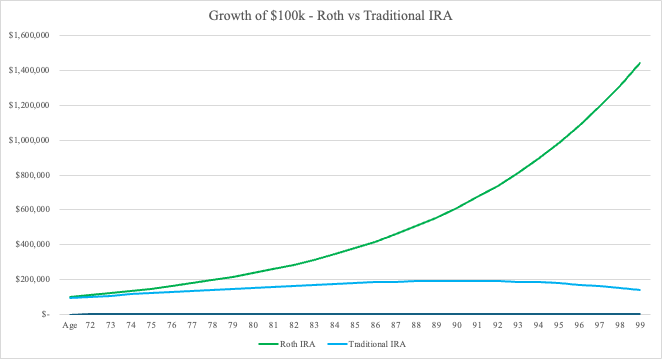

The incredible value of this feature can be easily understood through visual examples. Below, we’ve modeled the growth of $100k over 28 years, from the age 72 to 100, at an annual growth rate of 10% for a Roth account (the green line) and a Traditional IRA (the blue line).

Because the money in the Roth stays in the account, its value grows tremendously the Traditional IRA actually loses value due to RMDs, which completely negate the effect of investment earnings. As RMD’s must be taken no matter what, a market decline would make this even worse: you would be forced to sell investments at a loss and then pay taxes on the distribution, a double whammy.

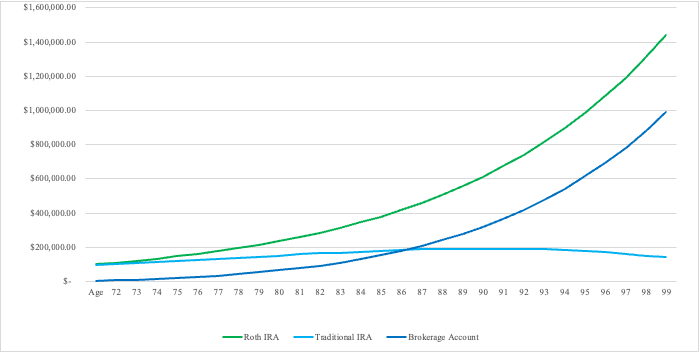

Admittedly, the situation is not quite as bad as it seems in the graph above. After paying taxes, you can reinvest RMDs in a brokerage account and continue to benefit from market returns. The following graph includes a brokerage account earning 10% annually in which RMDs are invested after a 24% tax bill.

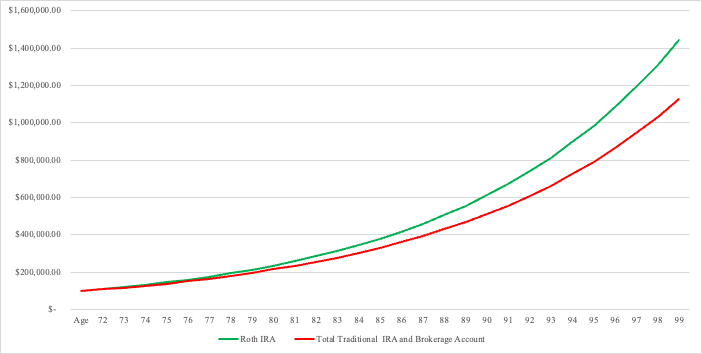

The sum of the Traditional IRA and the Brokerage account is compared with the Roth IRA’s value below.

Even when RMDs are reinvested, the effect of taxes on the value of your retirement savings is significant. Keep in mind that this example uses the lowest federal tax rate and any state income taxes would further reduce your savings.

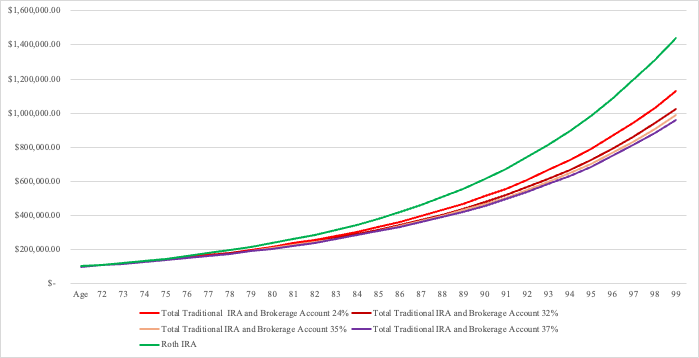

If you are in a higher tax bracket, the benefits of a Roth account really start to stand out. The graph below shows how different tax rates can impact your savings, making it easy to see why a Roth might be a smart move.

Using a Roth to avoid RMDs gives you more control over your taxable income in retirement, helping keep your taxes lower. Without the need to take RMDs, you have greater flexibility to manage your money on your own terms.

Estate planning advantages

The primary benefits of a Roth are tax-free growth and income, but they also come with some great estate planning perks. The tax-free nature of the account helps you pass more on to your heirs, and since your investments can grow for a longer period you can be more aggressive with your investment strategies. While most people inheriting a Roth IRA will need to take distributions, they won’t have to worry about paying taxes on that income. An additional benefit is that any estate taxes on the inherited account are covered by the original owner, not the person inheriting it.

All that to say Roth IRAs are a great way to pass down wealth to the next generation.

Roth IRA IRS Requirements - Eligibility criteria for Roth IRAs

Contribution limits and phase-out ranges

You can start growing your retirement savings with a Roth IRA at a young age, even before turning 18! As long as you’ve earned income during the year, you can open and contribute to a Roth IRA. There’s no age limit, so kids and teens with jobs can get ahead and start on building their nest egg. Plus, family and friends can contribute to a Roth IRA on behalf of a minor, as long as the child has earned income for that year.

There are a few rules to keep in mind when it comes to contributing to your Roth IRA. For 2024, the annual limit is $7,000 if you’re under 50 and $8,000 if you are 50 or older. This is the maximum amount you can contribute across all your IRA accounts - both Traditional and Roth. The limit tends to go up each year based on IRS guidelines, so it’s a good idea to stay up to date if you want to make the most of your retirement savings. A quick Google search will provide the latest contribution limit for the current year. The deadline for contributions is usually April 15th of the following year. For instance, the deadline for 2023 contributions is April 15th, 2024. If possible, it’s a good idea to max out last year’s contributions before adding to your current year’s amount.

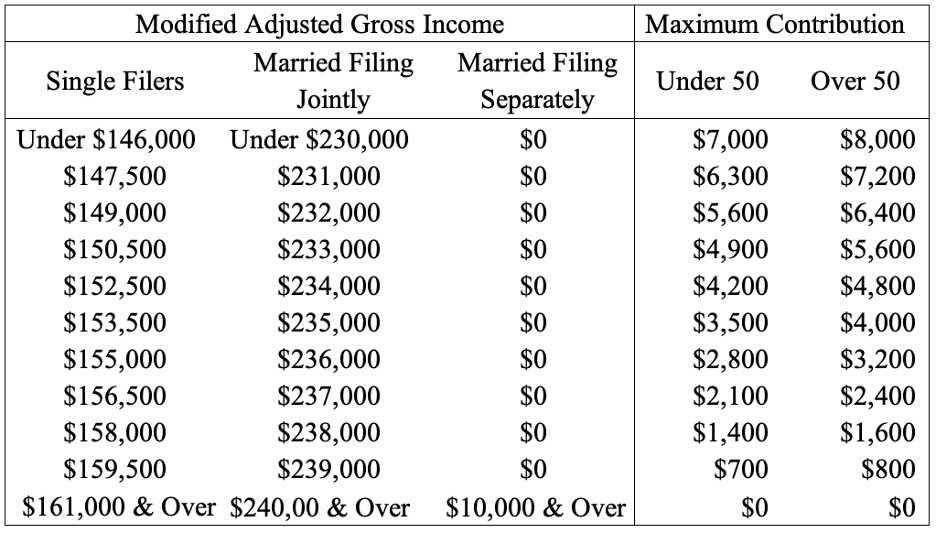

Roth IRAs also come with income limits that can affect how much you’re allowed to contribute. Your eligibility to make the full contribution depends on your Modified Adjusted Gross Income (MAGI). As your MAGI increases, the amount you can contribute might be reduced or phased out all together. Here’s a breakdown of how these income restrictions work based on different levels of earnings:

As your income increases, the amount you can contribute to your Roth account decreases. Unlike Roth IRAs, Traditional IRAs don’t have income limits for contributions, so it can be smart for younger investors to take advantage of Roth accounts while their earnings are still on the lower side.

Backdoor Roth IRA Contributions

Because of these restrictions, high earners can miss out on the tax-free growth and withdrawals that make Roth accounts so valuable. Using other retirement options like Traditional IRAs and 401(k)s can lead to higher taxes in retirement and make it harder to transfer wealth efficiently to heirs.

The good news is that there are strategies to get around these rules. High-income investors can take advantage of “Backdoor” Roth conversions to bypass the contribution limits and phase-out restrictions. You can do this by contributing to a Traditional IRA and then converting those dollars to a Roth IRA. It’s completely legal and allowed under IRS rules.

If you have been saving into a Traditional IRA or 401(k) for a while, you can also convert your entire account balance into a Roth IRA - there’s no limit to how much you can roll over. One stipulation for 401(k) account rollovers is that your account must allow these conversions - check with your plan sponsor to see if this option is available to you.

Transfers between accounts are usually simple and can be done through custodial banks or brokerage platforms

One key detail is that the money moved from a Traditional IRA to a Roth IRA is treated as a conversion, not a contribution. If you’re under 59 1/2, you’ll need to wait five years before accessing those converted funds without penalties, while regular contributions can be withdrawn at any time.

Tax Implications

When transferring funds from a Traditional IRA or 401(k) to a Roth IRA, you must pay ordinary income taxes on the amount transferred. However, if you’ve made after-tax contributions to your Traditional IRA or 401(k), those funds won’t be taxed when moved to a Roth IRA. Only the pre-tax contributions and any gains will be subject to taxes at the time of conversion.

Conversions can result in significant tax bills. High-income earners in particular will face a lofty tax bill due to the conversion. Before following through with this strategy, you should weigh the benefit of the tax savings you’ll receive from a Roth with the tax bill caused by the conversion. One way to mitigate your taxes is to spread the rollover out over a number of years - this can help you by preventing a jump to a higher tax bracket.

Mega Backdoor IRAs

High-income individuals can also use a Mega Backdoor Roth IRA conversion to contribute well beyond the usual annual limits. Whether this strategy is available depends on the specific features of your 401(k) or workplace retirement plan.

With this approach, you first make after-tax contributions to your 401(k) or similar workplace plan, then convert those funds to a Roth IRA. The key here is the after-tax contributions - when making after-tax contributions, employees under 50 can contribute up to $69,000 to employee retirement plans each year while those over 50 can contribute up to $76,500. In contrast, if you’re contributing pre-tax, the maximums drop to $23,000 for those under 50 and $40,500 for those 50 and older. This is why it is so beneficial to contribute pre-tax, as the amount that can be rolled into a Roth IRA increases substantially.

Since the typical annual contribution ceiling for Roth IRAs is only $7,000 ($8,000 for those over 50), the Mega Backdoor conversion offers a way to contribute far beyond those limits. This strategy lets investors fully capitalize on tax-free growth, making it an attractive option for high-income individuals looking to maximize their retirement savings.

Those considering this strategy should be aware that after-tax contributions to a workplace retirement plan may not qualify for an employer match. However, you can contribute pre-tax to receive the employer match up to the pre-tax limit, and then add after-tax contributions until you reach the after-tax limit. This balance between pre and after-tax contributions can help you maximize both your employer match and your tax advantages. Keep in mind that when you convert the funds to a Roth IRA, any growth on the original contributions, as well as any pre-tax contributions, will be taxed at the time of conversion. Because of this, you’ll benefit from converting your 401(k) contributions to a Roth IRA as soon as possible.

In terms of estate planning, Roth conversions offer the advantage of allowing the original account owner to pay taxes upfront, effectively reducing the tax burden on their heirs. Additionally, if your estate exceeds the exemption amount, Roth conversions can help reduce your taxable estate because the taxes are paid by you, the original owner. This lowers the overall value of the estate, which in turn reduces the inheritance taxes of your heirs. As a result, Roth conversions can minimize both the income tax and estate tax liabilities that heirs would otherwise face.

Roth IRA Rules

Withdrawal rules (qualified vs. non-qualified distributions)

You can withdraw your contributions from a Roth IRA anytime, without penalties. However, to withdraw any earnings tax and penalty free, you’ll need to meet two conditions: you must be at least 59 1/2 years old and your Roth account must have been open for at least five years.

Withdrawing form a Roth IRA before age 59 1/2 usually means you’ll face ordinary income tax and an additional 10% penalty. If your account is less than 5 years old, even if you are 59 1/2 or older, withdrawals of earnings will be taxed as ordinary income. You won’t face the 10% penalty ion this case, however.

The early withdrawal penalty (but not income taxes) can be avoided on distributions made before age 59 1/2 in these situations:

- Qualified education expenses.

- Certain emergency expenses.

- Expenses in connection with a federally qualified disaster.

- Qualified expenses related to birth or adoption.

- If an investor is a survivor of domestic abuse.

- Payments for unreimbursed medical expenses or health insurance if the investor is unemployed.

- Distributions made in substantially equal payments in accordance with IRS rules [1].

Roth IRA Inheritance Rules

The rules for inherited IRAs vary depending on who the beneficiary is. if you’re a spouse inheriting a Roth IRA, you have the most flexibility. You can roll the entire balance into your own Roth IRA and treat it as if it’s always been yours. Alternatively, you can take Required Minimum Distributions (RMDs) each year based on your life expectancy, distribute the full balance within 10 years, or simply take a lump sum. No matter what you choose, you won’t owe any taxes.

When a non-spouse inherits a Roth IRA, the withdrawal rules depend on the type of beneficiary you are. The two categories are Eligible Designated Beneficiary and Designated Beneficiary.

Eligible Designated Beneficiaries include minor children of the original account owner, people who are chronically ill or permanently disabled, and those who are not more than 10 years younger than the original account owner. If you fall into this category you can spread distributions over your remaining lifetime. RMDs must start by December 31st of the year following the original account owner's death. You can also choose to distribute the entire account within 10 years or take a lump sum. Minor children are only eligible until they turn 18, after which they must empty the account within 10 years of their 18th birthday. The good news is that no taxes will be owed on withdrawals.

Designated Beneficiaries are those who don’t qualify as Eligible Designated Beneficiaries. If the original account owner passed away after 2019, you’ll need to fully distribute the account within 10 years of their death. When the account owner passed away before 2019, you have the option to spread RMDs over your lifetime. If available to you, this method is valuable as it allows Roth funds to grow tax-free for longer.

Strategies for maximizing inherited Roth IRA benefits

If you are a Designated Beneficiary, it can be smart to delay most distributions from the inherited Roth IRA until the 10th year, allowing your account to grow tax-free for as long as possible. In the meantime, you can take smaller distributions to fund your own retirement accounts and maximize the tax-advantaged growth of both your inherited Roth and your personal retirement savings.

Roth IRAs offer significant tax benefits for inheritors since withdrawals don’t count as ordinary income. This can be especially valuable for younger people who inherit a Roth IRA, as they can access the funds tax and penalty free anytime. The account can be used to help pay for important life milestones like buying a home, funding education, or investing in opportunities that help heirs get ahead financially.

Types of investments allowed in Roth IRAs

Roth IRAs operate just like regular brokerage accounts and allow you to hold a wide range of assets. However, most are limited by custodians to common investments like stocks, bonds, mutual funds, ETFs, Target Date Funds, real Estate Investment Trusts (REITs), and Certificates of Deposit (CDs). If you're interested in holding alternative assets such as private placements, limited partnerships, real estate or commodities, you can do so through a Self-Directed IRA (SDIRA). You’ll need to find a custodian who specializes in SDIRAs and offers the specific assets you’re looking for.

[1] Rule 72(t) allows account owners to take penalty-free early withdrawals from IRA, 401(k), and 402(b) accounts. To execute a 72(t) withdrawal, the account owner must take at least five substantially equal periodic payments. Payment amounts depend on the owner's life expectancy as calculated through IRS-approved methods. The IRS offers three options for calculating withdrawal schedules. Once initiated, the plan must be followed for five years or until the account owner reaches age 59 ½, whichever comes later.

One important difference between a Roth IRA and a normal brokerage account is that you cannot borrow money from your Roth account or use the account as collateral for a loan. Since loans aren’t allowed, trading on margin is also prohibited. Additionally, you can’t sell property to your IRA or buy property for personal use with IRA funds.

Strategies for maximizing Roth IRA growth

A major benefit of investing is compounding - the process of reinvesting your returns so they generate additional gains over time. The longer your money has to compound, the greater your investment balance can grow. To fully harness this, it’s best to start contributing to a Roth IRA as early in life as possible, especially when you’re in a lower tax bracket. This way you maximize the compounding effect and increase the long-term benefits of tax-free withdrawals in retirement.

To maximize the time your money is invested, it is wise to make your contributions as early as possible each year - or even at the start of every month - so your money spends more time in the market.

Another important consideration is deciding which investments to hold within your Roth IRA. For example, bonds might be a good choice since interest payments are taxed as ordinary income, and you can avoid these taxes by using a Roth to purchase those assets. Capital gains from stocks are taxed at a lower rate and might be better held in a taxable brokerage account.

However, the benefits from tax-free growth on your stock investments may far outweigh your tax savings on interest income. Young investors especially profit more from holding equities in their Roth, as their growth potential is much higher and earnings are not taxed in Roth accounts. The longer time horizon young investors have allows them to ride out market volatility and take advantage of long-term gains. In fact, market downturns can present buying opportunities for them, enabling them to purchase stocks at lower prices and increase potential gains.

Younger investors can cover living expenses with their income and leave their investments to grow untouched, but as retirement approaches investors must consider the risks of market declines more seriously. Since they will soon rely on their retirement accounts to fund their living expenses, they have less time for their portfolios to recover from any declines in value. This makes protecting the value of their account a top priority as they shift their focus from growth to preserving the wealth they’ve accumulated over the years.

Thus, as investors age it is common to gradually shift their investments away from equities, which are more volatile and risky in the short term, toward more stable investments like corporate and government bonds. These bonds provide steady, positive returns while helping to protect your account value.

The way each person adjusts their portfolio as they age depends on their individual risk tolerance and personal circumstances. For example, someone with a higher appetite for risk, large portfolio value, or relatively low expenses in retirement may feel comfortable with larger stock investments for longer, as they can weather market volatility and still meet their financial needs. On the other hand, those with lower risk tolerance or higher anticipated retirement expenses may shift more quickly to safer, income-generating investments like bonds to protect their account balance. The specific strategy each person utilizes reflects their unique situation and goals.

Ultimately, balancing long-term tax-free growth from equities with minimizing taxes on interest payments from bonds will help you maximize both your income tax savings and your account value.

Is a Roth IRA Worth It?

Roth IRAs are especially advantageous if you expect to be in a higher tax bracket during retirement than you are now. In this case, you pay taxes on contributions at a lower rate today rather than facing higher taxes on withdrawals from tax-deferred accounts like Traditional IRAs or 401(k)s. This makes Roth IRAs particularly advantageous for low-income workers and younger investors, as they can lock in today’s lower tax rates while benefiting from tax-free withdrawals in retirement. Because of these factors, Roth IRAs are often a priority over other savings options for these groups.

Roth IRAs also offer great benefit for those who pay high taxes in retirement as withdrawals do not count towards taxable income. This means they can access funds without increasing their tax burden, allowing them to manage their tax bill while meeting their retirement needs.

Individuals who can cover their living expenses with other funds benefit even more from Roth IRAs, as the account can keep growing tax-free for as long as they choose. this provides more flexibility and potential for wealth accumulation later in life and for the next generation.

In summary, Roth IRAs are an incredibly valuable tool for investors of all ages and income levels.

Potential drawbacks or limitations of Roth IRAs

You should be mindful of several limitations and potential drawbacks of Roth IRAs. Unlike Traditional IRAs and 401(k)s, Roth IRAs don’t offer any current year tax advantages because you contribute with after tax dollars. Traditional accounts, by contrast, help reduce your current-year tax liabilities.

Another limitation is the contribution cap, which is set at $7,000 for individuals under 50 and $8,000 for those 50 or older, limiting the power of Roth IRA accounts. Income limitations further restrict high earners from contributing directly to a Roth IRA. While there are ways to get around these restrictions such as backdoor Roth conversions, they require careful planning and administrative diligence to execute correctly.

When deciding between Roth and Traditional IRAs, you should consider your current and future tax brackets. While it’s challenging to predict your future income, Roth IRAs provide the most benefit when you expect to earn less now than you will in retirement. In this case, paying taxes upfront at a lower rate offers significant advantages compared to deferring taxes through a Traditional IRA and potentially paying more later.

Withdrawal rules and flexibility are also crucial considerations when choosing between Roth and Traditional IRAs. Mandatory withdrawals can increase taxable income in retirement which limits financial flexibility. The absence of RMDs for Roth IRAs gives you greater control over withdrawals and enables your investments to grow tax-free for longer.

Estate planning is another important factor when deciding which account is right for you. Roth IRAs offer significant perks for heirs, as inheritors can receive the account balance tax-free. Heirs also benefit greatly from the lack of RMDs in Roth IRAs, as the investments have been allowed to grow tax-free throughout the original owner’s lifetime.

Conclusion

To recap, Roth IRAs offer the distinct advantage of tax-free growth on investments once you make after-tax contributions. These accounts are an excellent tool for building retirement savings and provide notable value to heirs, who can inherit the account balance tax-free. They also empower you to control your retirement income, helping you reduce tax liabilities.

If you decide to invest in a Roth IRA, it is essential to consider your current and future tax rates and income levels. By thoughtfully evaluating these factors, you can maximize the long-term value of retirement savings.

For young investors with plenty of time to let their investments grow, the tax-free nature of a Roth IRA is a huge advantage and even high-income earners can benefit by using strategies like Backdoor Conversions. By balancing Roth IRAs with other investment accounts, you can optimize retirement income and keep your tax burden as low as possible

Consider assessing your financial situation with a financial professional

Planning for retirement is an essential and ongoing process in all of our lives, and choosing the right accounts and investments is crucial for long-term financial success. Each person’s situation is unique, so it is important to tailor strategies to fit your individual needs.

While it’s hard to know where to start, you can begin by reviewing your current income and retirement goals. First, consider your potential future income and your current and projected tax brackets. Then evaluate decisions you can make now to increase future financial stability, such as how much you can afford to save each month into a retirement account.

Navigating the complexities of retirement planning and corresponding investment decisions is a challenge that requires constant attention. A Financial adviser can help you make the best choice in each situation and empower you to live your best life in retirement.

When thinking about your own financial plan, consider scheduling a consultation with a financial professional to ensure you are on the right path toward a secure and fulfilling retirement. An effective financial plan makes the most of retirement savings and provides the comfort that comes with knowing you are prepared for the future.

That's all for now - don't forget to enter your email below to become an Insider. You'll receive our newest articles delivered straight to your inbox in a weekly Dispatch. Plus, you'll get updates and exclusive content just for joining. Welcome to the team!

Comments ()