9 Weeks and the Rest of Your Investing Life

The average college semester lasts between 15 and 17 weeks. If you're on the quarter system it's even shorter - anywhere from 8 to 11 weeks. While for many that might feel like an eternity, in finance and in the public markets it's but a fleeting moment. One thing I never understood during my undergraduate journey was why professors do investment simulations over such a short time period. Copious amounts of empirical research indicate that short-term market movements (less than half a year or a quarter) are nothing but emotions or a random walk.

Having already been put through the ringer on this, I feel that these simulations possibly reinforce the short-term motivations that plague many investors, young and old. I also worry that once these simulations are done, investors wipe their hands, move on to the next course, and forget about an investment foundation that could have been great - or really horrible for that matter. So, why don't we revisit one of my college nine-week simulations today? It’s going to be fun.

Academic Research and Writing

I've recently fallen back in love with academic research and writing. This summer, I had the opportunity to work on a chapter in a textbook on risk and return during inflationary periods, as well as statistical analyses of multinational corporations' exposure and its potential reflection in their stock performance. I'm also involved in a project on negative cash conversion cycles for tech equity companies. Over the weekend, I further helped a colleague of mine who is still in college with some of her required writing. It’s a lot more fun when it’s not required - and you don’t have to worry about grades.

Helping her made me reflect on some of my earlier academic projects. These assignments, often required for classes, were—to put it bluntly—pretty garbage. I know this from parsing through my really, really old Google Docs items. I'm talking about papers that I wrote back when I was at Seattle University. During this search, I found somewhat of a hidden gem – a paper I had written in the last finance class I took at Seattle University. This was during the spring quarter of 2021, right before we entered one of the most fascinating market environments ever experienced—one we've now lived through and emerged from.

I don't think I have to explain what those markets looked like, but to recap:

- Inflation went from 2% to 9.1%

- The federal funds rate went from literally 0% to 5.5%

- The S&P 500 fell 20-25% and then spent the next year and a half going back towards all-time highs

- Two recessions took place

- A bunch of horrible companies went belly up

- Some banks failed

- Everybody and their mother-in-law thought we were headed for the end of days

If you’d like to read the original paper - download it here. I make no promises or warranties about its professionalism.

Revisiting the Past: An Investment Simulation

In keeping with the spirit of using amazing AI tools—which I initially dismissed as limited—I decided I was going to take this previous paper that I had written and project the investment strategy forward. The paper explained my takes on a hypothetical $100,000 investment portfolio, starting in late March of 2021. The class ran for nine weeks. In my write-up—which was riddled with grammatical errors and first-person perspective (a big no in academic writing)—I emphasized that nine weeks is far too short a period to make any meaningful investment assessment.

Nine weeks fly by faster than the five years since high school graduation. Nine weeks moves faster than you can restock your groceries or clear out your email inbox. Nine weeks is like a blink of an eye. That was one of the first things I mentioned in this report. And outside of that, it doesn't really provide any value for approximating the future.

However, in the report, all of my investment rationale is worded out. While the grammar and syntax might not be great, the but there’s enough info recall what this portfolio might have looked like. Here’s a preliminary view:

The Portfolio and Analysis Process

The portfolio was equal-weighted at $100,000. It had six positions:

- Long position in Bitcoin

- Long position in Ethereum

- Short position in GameStop

- Short position in a SPAC ETF

- Long position in the home building sector

- Long position in the industrial sector

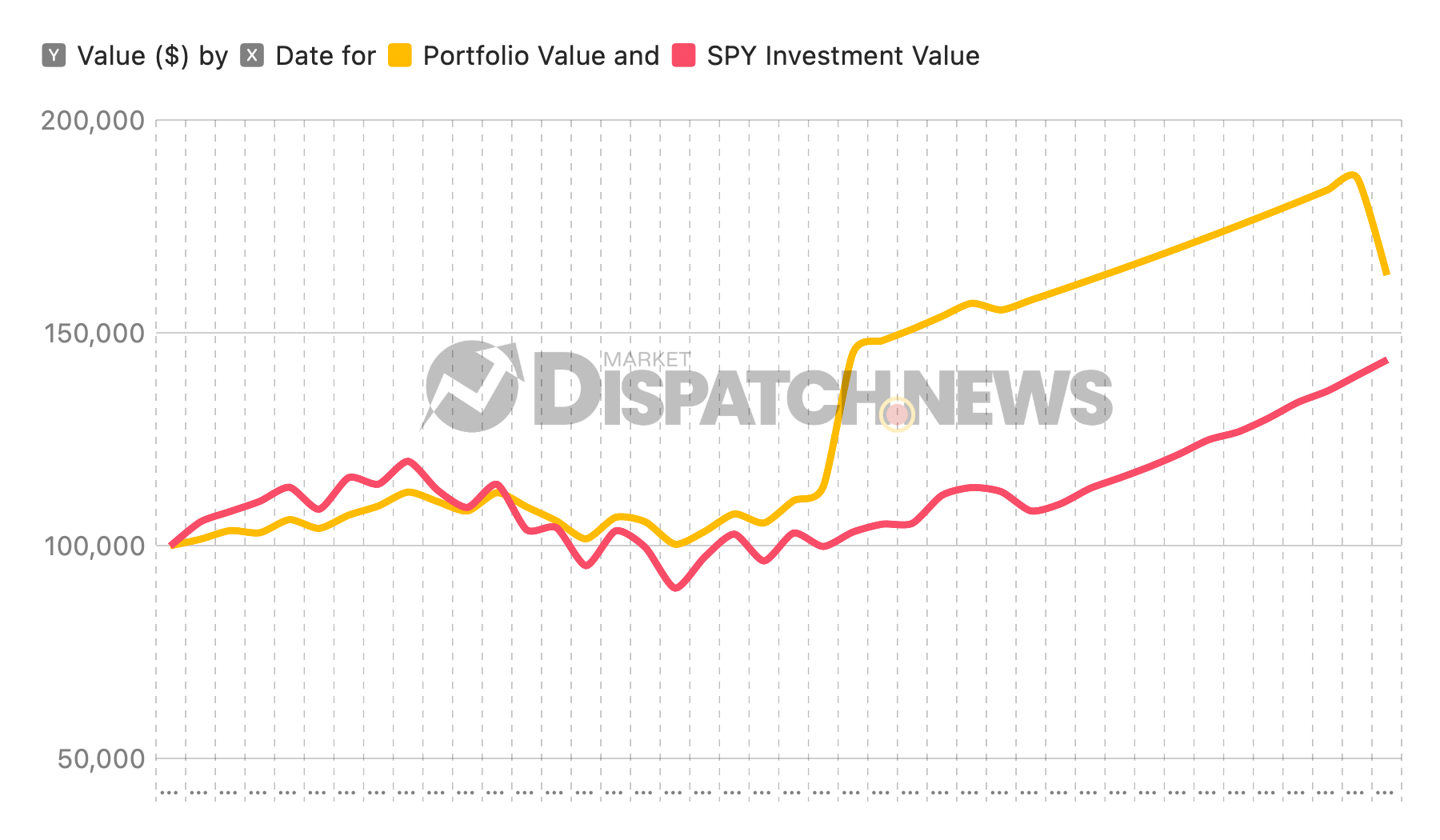

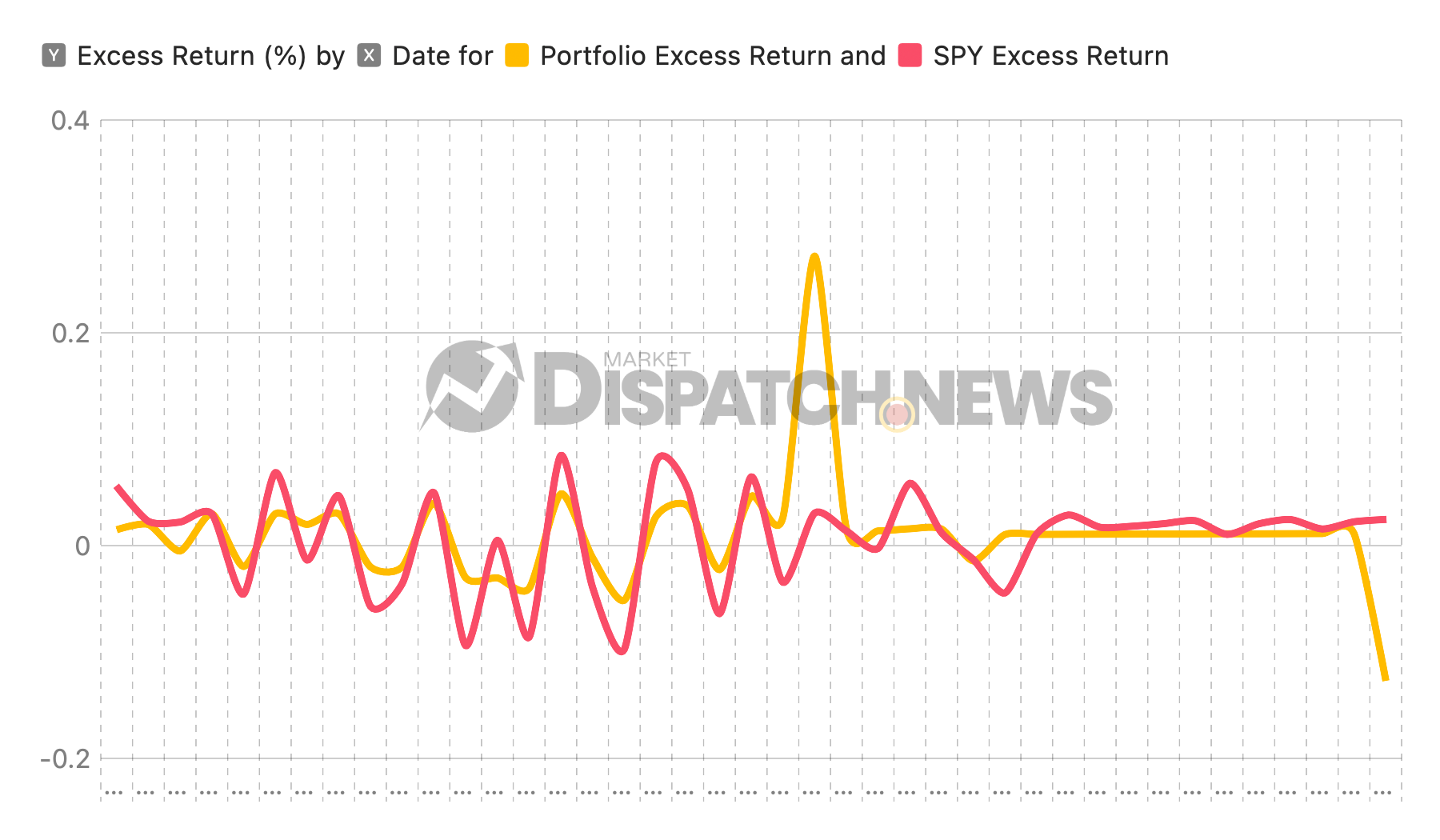

For our performance reporting, it's worth calling out that the SPAC index we were short was actually shut down. As of February 2023, not a single fund continues to track De-SPAC companies. From this point, our AI assistant assumed the proceeds from closure of this short were re-allocated evenly to the remaining positions. Thus, there was one portfolio rebalance, and one period which you’ll see the portfolio jumped drastically ahead of the S&P 500 index from closing the short.

We input these aforementioned six positions into the latest OpenAI model (GPT-4 o1, which excels at advanced mathematical reasoning) and provided it with in-depth rationale for the portfolio and investment philosophy. From there, o1 proceeded to request the data needed for return calculations and associated statistical tests. We provided the monthly data for those securities from Yahoo Finance or Morningstar. Then we let it get to work.

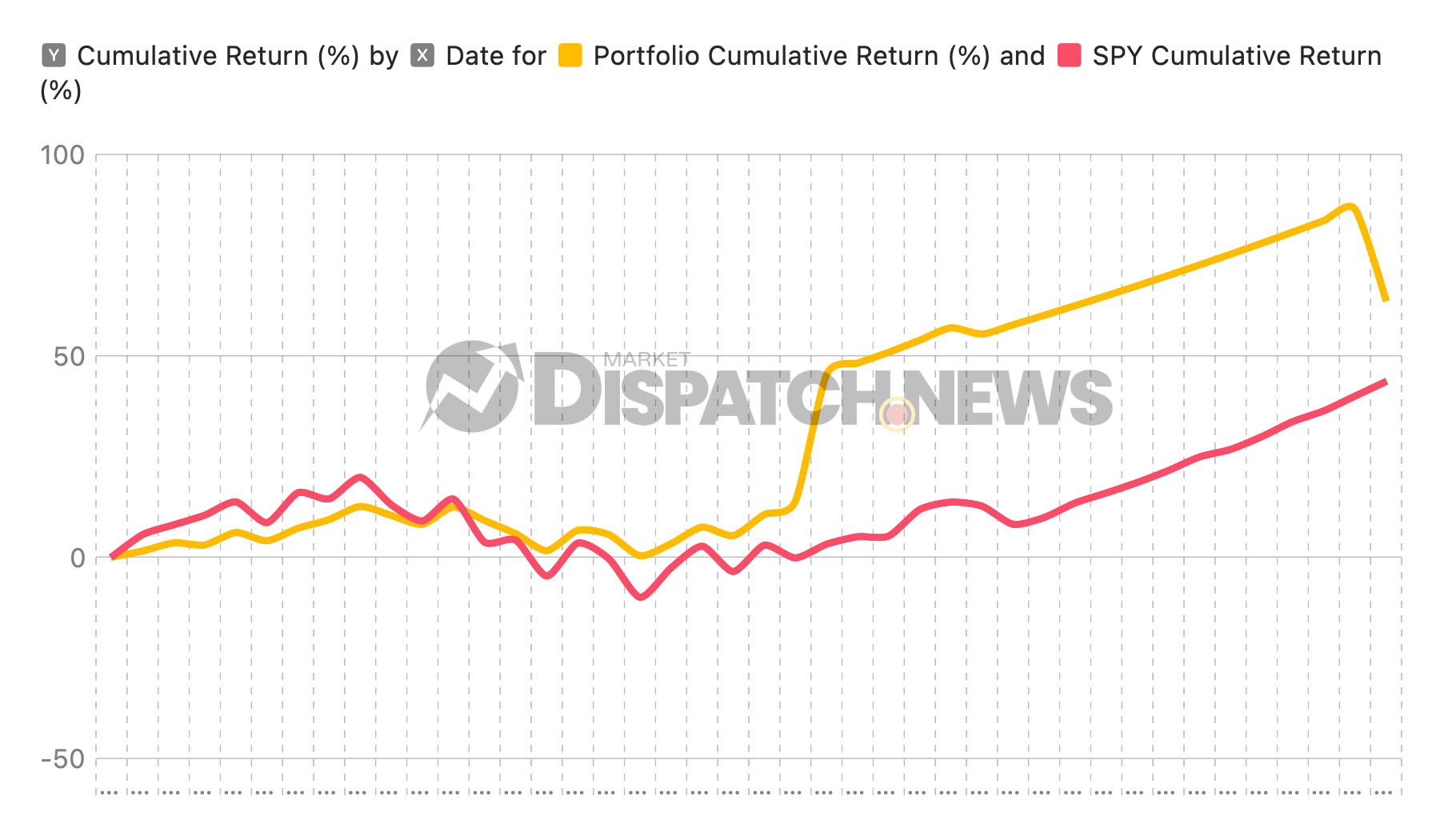

So, powered by AI in its entirety - I'm going to show you exactly how my freshman year of university $100,000 project went. Admittedly, the returns were a lot better than the writing. After analyzing this data and understanding the rationale behind it, I had it write a comprehensive shareholder update report on what happened. Some key performance data is available below for your review.

| Metric | Portfolio | S&P 500 |

|---|---|---|

| Total Return | +63.71% | +50.00% |

| Annualized Return | +18.13% | +12.47% |

| Annualized Volatility | 21.65% | 13.50% |

| Sharpe Ratio | 0.698 | 0.700 |

| Beta | 1.05 | 1.00 |

| Alpha | 0.42% per month | N/A |

| R-squared | 0.75 | N/A |

A Final Word on AI and Investment Analysis

Please note: All of this was done within a 90-minute period with completely free information, and outside of the $60 a month Macfarlane Investors pays for the enterprise ChatGPT plan, this cost no money whatsoever.

I'm also really excited to announce we have a new contributor in the Dispatch who is working on a bold predictions piece for AI, which is on its way. I'll highlight that piece when it's published. After this experiment, I'm convinced that within the next decade, tasks such as mathematical reasoning, coding, and creating generic UI experiences or reports will be achievable with just a few prompts. This shift promises to revolutionize how we approach complex analytical tasks.

It's a lot of fun. A whole area of the SaaS world (the ‘software as a subscription’ world), is going to be completely taken out. I say this as someone who recently canceled one of my favorite tools—Riskalyze (or Nitrogen). It’s a tool I’ve paid roughly $400 a month for over the past 3 years. All the data their models are built on is either publicly available or can be purchased for less. This data can then be fed into a GPT or similar AI tool for calculations…all done in house.

And then from there, it can generate markdown and it can generate the images to create the reports. And we are still in inning zero. In the next 10 years, every specialized piece of software that has required engineers to do the upkeep is now going to be replaced by utilitarian tools that can really create anything, and allow for a greater level of customizability for whoever is using it.

Our very initial 2025 goal for us at Macfarlane to replace the entire tech stack with internal AI tools. We're actively working on this, and I hope this exercise shows not only its feasibility but also the exciting future it presents for investors like myself and others eager to leverage this groundbreaking technology.

Please see below for the full AI-generated portfolio report.

Comments ()